Citizenship & Immigration

We’re Here to Help

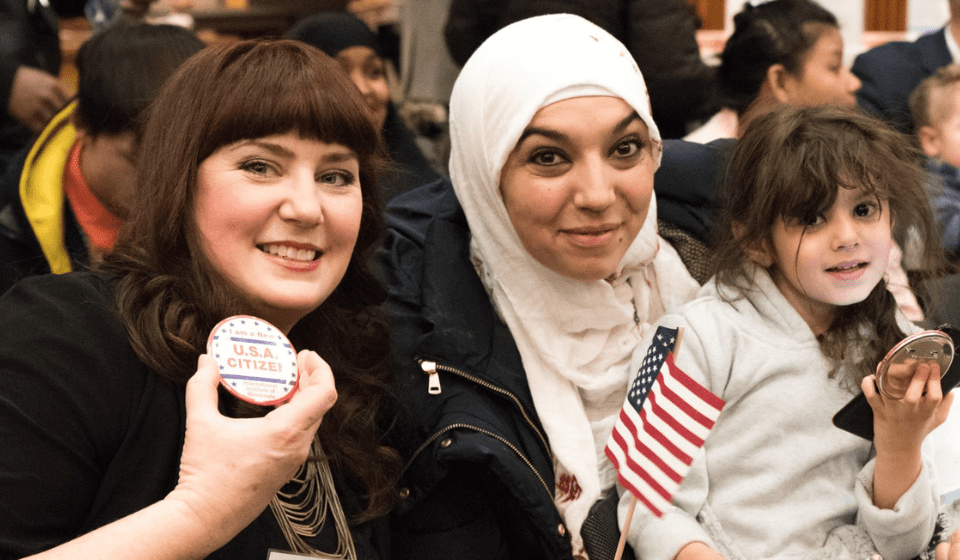

We provide low-cost immigration legal assistance for refugees and immigrants living in Minnesota. Contact our team if you would like guidance and support with your immigration application.

Call (651) 377-8642 and leave one voicemail message. We will return your call within 1-2 business days.

Our Reach

We assist over 2,000 refugees, asylees and immigrants with citizenship and immigration help each year. We believe that investing in the success of immigrants is an investment in the success of the community and the state of Minnesota.

Thanks to support from generous donors and volunteers, our Immigration Services team achieved several milestones last year:

-

Success Rate

for our citizenship clients.

-

New Americans

became U.S. citizens with IIMN help since 2001.

-

Saved

by IIMN clients on citizenship application fees to U.S. Citizenship and Immigration Services last year.

Why Citizenship?

Becoming a U.S. citizen has many advantages. Some of the benefits of citizenship include:

- Travel freely with a U.S. passport and live outside the U.S.

- Vote in elections and run for elected office

- Create a citizenship pathway for your eligible children

- Access additional and higher-paying job opportunities including government work

- Reunite with family members in the U.S.

- Access benefits reserved for citizens such as certain scholarships

- Feel a sense of community knowing you’re a permanent citizen of the U.S.

Call to request an appointment:

651-377-8642.

Frequently Asked Questions

- Citizenship (N400)

- Citizenship Appeal/Hearing on Decision (N336)

- Citizenship through Parent (N600)

- Green Card (I485) – for Refugees, Asylees, and T visa holders ONLY

- T Visa (Trafficking)

- Replacement/Renewal of Green Card (I90)

- Employment Authorization Card (I765)

- Replacement of Citizenship Certificate (N565)

- Remove Conditions on Green Card (I751)

- DACA Renewal

- Freedom of Information Act (G639)

- Records/Copy Request

- Request for Evidence (RFE)/Notice of Continuance

The Institute provides low-cost immigration legal help to refugees and immigrants. No applicant will be turned away for inability to pay.

Getting citizenship takes a while, depending on where you live. After USCIS receives your application, the process can take 6 months to 2 years, or longer. It includes waiting for:

- a receipt and notice from USCIS

- a biometrics (fingerprinting) appointment

- the interview and test at USCIS

- a naturalization ceremony to take the oath.

To see how long the process takes in your area, check USCIS Processing Times. Under “Form,” scroll down and click “N-400.” Under “Field Office,” pick the office near you.

Yes. We have access to interpreters and staff who speak different languages. You are also welcome to bring your own interpreter.

The majority of citizenship applicants have to speak English in order to become a U.S. citizen and we encourage you to practice speaking English to prepare for the interview.

Classes and Job Trainings

-

Citizenship Class

Prepare for the U.S. citizenship test and interview in this class. For students with beginning English skills.

-

English

Learn how to read, write and speak English. From literacy to pre-college readiness, we teach all levels of adult English classes.

-

Housekeeping Training

Learn cleaning skills to work in hotels, nursing homes, hospitals and office buildings. For students with beginning English or no work experience in the U.S. Graduates receive help finding a job.

Become a Volunteer

You can make an impact by helping qualified applicants with their citizenship application. Click to view our current volunteer needs.

Funding

Portion of funding for Citizenship & Immigration Services attributed to Minnesota Department of Human Services, Resettlement Programs Office (RPO).

Need Help? We’re Here for You.

Call us if you have an immigration question or need to make an appointment.

Immigration Intake

(651) 377-8642